- The BLVD Distribution

- Posts

- Benefits of Buying In a High Interest Rate Environment

Benefits of Buying In a High Interest Rate Environment

The BLVD Distribution

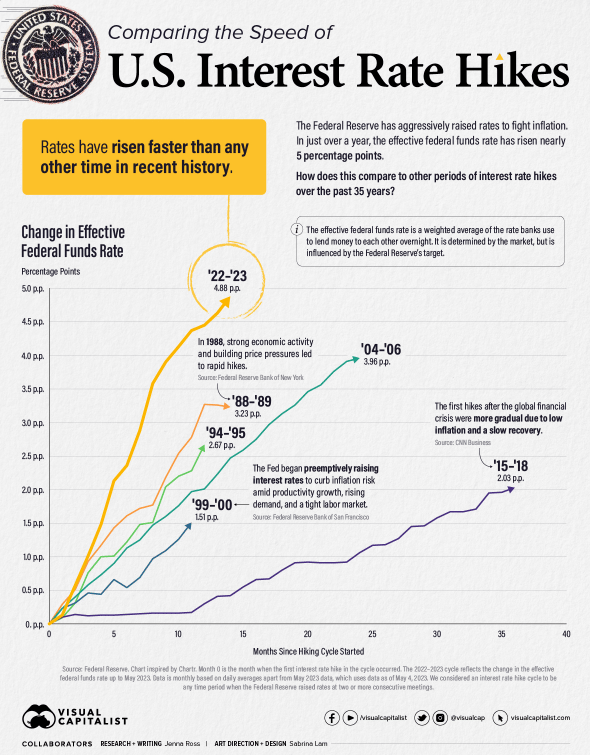

Since the first rate hike in March 2022, interest rates have risen faster than at any other time in recent history. This rapid increase has caused some havoc in the commercial real estate world. Those with expiring bridge loans are facing forced sales. Expiring rate caps, which once protected borrowers from rising rates, now expose them to higher costs. Additionally, rising interest rates are impacting property values and cap rates. Despite these challenges, we believe the current environment presents valuable opportunities for buyers. Let's examine some of the fallout contributing to these opportunities.

Ross, Jenna. “U.S Interest Rate Hikes.” Visual Capitalist,2023. https://www.visualcapitalist.com/interest-rate-hikes-1988-2023/

The Fallout

Bridge Loans

Deals that rely on bridge loans are facing challenges as these short-term debt instruments mature. Typically structured with repayment due within 2 to 3 years, many owners planned to refinance when rates were anticipated to be around 5%. However, with current rates climbing to 7% or higher, refinancing into a permanent loan is no longer feasible. This predicament forces property owners to sell their assets rather than hold onto them as originally planned.

Rate Caps

Rate caps, which guarantee that interest rates won't exceed a specified percentage, are also expiring and presenting challenges. These financial products were purchased to hedge against floating-rate debt. Just a few years ago, a rate cap might have been acquired for $50,000, providing short-term protection that required renewal every couple of years. Now, due to rising interest rates, the substantial increase in the cost of renewing these rate caps has led to the collapse of some deals.

Interest Rates & Cap Rates

As interest rates increase, property values tend to decrease. This trend is particularly challenging for investors who prioritize cash flow, as higher debt service payments reduce the net cash flow generated by the property. To understand the impact more clearly, let's do the math.

Interest Rates

$5M Loan with a 3% Interest Rate

Income: $1M

Operating Expenses: $500K

Annual Debt Service: $285K

Free Cash Flow: $216K

$5M Loan with a 6% Interest Rate

Income: $1M

Operating Expenses: $500K

Annual Debt Service: $386K

Free Cash Flow: $114K

As you can see, with a 6% interest rate, the same deal incurs an additional $101,000 in debt service costs and sees a reduction of $102,000 in free cash flow.

Cap Rates

When interest rates rise, the capitalization rates, or cap rates, adjust accordingly. For instance, what was once a 6% cap rate can increase to 7%. As cap rates increase, property values generally decrease because the income generated by the property is divided by a higher rate, resulting in a lower valuation. This dynamic can make it more challenging for sellers to achieve their desired sale prices and can present opportunities for buyers to negotiate better deals.

Strategic Buying

Schneider Howard. “Fed leaves rates unchanged…” Reuters, 2024. https://www.reuters.com/markets/rates-bonds/fed-expected-hold-rates-steady-project-fewer-cuts-2024-2024-06-12/

Our goal is to buy now, capitalizing on the current market conditions. Given the Fed's projection that the Fed funds rate will eventually drop to around 3%, the current higher rates make purchasing now, and refinancing or selling in a future lower-rate environment, very attractive. However, as operators, we must not rely solely on these projections. Our current strategy is to lock in fixed rates for as long as possible while negotiating flexible prepayment penalties. This approach ensures that if rates drop, we are ready to take advantage. If a deal looks good with the Fed funds rate at 5%, it will look even better if they drop to 3%.

In conclusion, the rapid rise in interest rates has undoubtedly created challenges in the commercial real estate market, but it also presents unique opportunities. With some owners pressured to sell, current market conditions enable us to negotiate better purchase prices and take advantage of potential "fire sale" opportunities. By understanding the implications of bridge loans, rate caps, and cap rates, and by adopting a strategic approach to debt management, we can navigate this environment effectively and position ourselves for success in both the short and long term.

Thank you for reading and your interest in BLVD Ventures. We look forward to having you follow along. Feel free to reach out anytime with questions and connect with us further using the button below.